Labour's proposal for a 'genuine living wage' has raised concerns from HSBC economists regarding the potential for this policy to trigger job losses and increased mortgage costs for households. HSBC warns that raising the minimum wage beyond inflation adjustments could inflate costs for businesses and, consequently, for consumers.

The minimum wage already saw a significant boost from £10.42 to £11.44 in April, driving employers' wage bills up an average of 20 percent in the past two years. While economists believe pushing wages further could impact employment levels, HSBC also acknowledges the possibility for the 'genuine living wage' to foster productivity and employment by enticing more people into the workforce.

Amid these challenges, the Bank of England remains focused on service sector inflation. With interest rates at a 16-year high of 5.25%, the Bank is reluctant to ease rates until confident that services inflation subsides. HSBC economists warn, "High wage growth is fueling inflation in the UK at the moment," reinforcing the Bank of England's stance on keeping interest rates elevated.

High wage growth, while beneficial for workers, places upward pressure on inflation, leaving central banks like the Bank of England in a precarious position. They must balance fostering economic growth and keeping inflation in check. Prolonged high-interest rates strain mortgage holders who already grapple with increased borrowing costs, leading to financial hardships for many households.

Facing these intertwined issues, the Bank of England's cautious approach seems justified. Keeping interest rates high until there is definitive proof of controlled inflation may be the pragmatic path, albeit fraught with its own set of challenges.

The potential outcomes of Labour's 'genuine living wage' initiative present a complex scenario. HSBC economists offer a tempered view, cautioning that while the benefits of higher wages are conceivable, they might be overly optimistic. A critical concern is balancing the potential gains with the economic strain of elevated wage bills.

Furthermore, the looming threat of sovereign debt impacting economic recovery remains in the background. If the proposed wage increases lead to substantial inflation pressures, it could force the Bank of England to keep rates higher for longer, impacting mortgage holders facing already steep borrowing costs.

However, there's also a thin thread of optimism woven into the narrative. If the workforce expands and more people find employment, the additional productivity could offset some inflationary impacts by boosting the economy's output capacity.

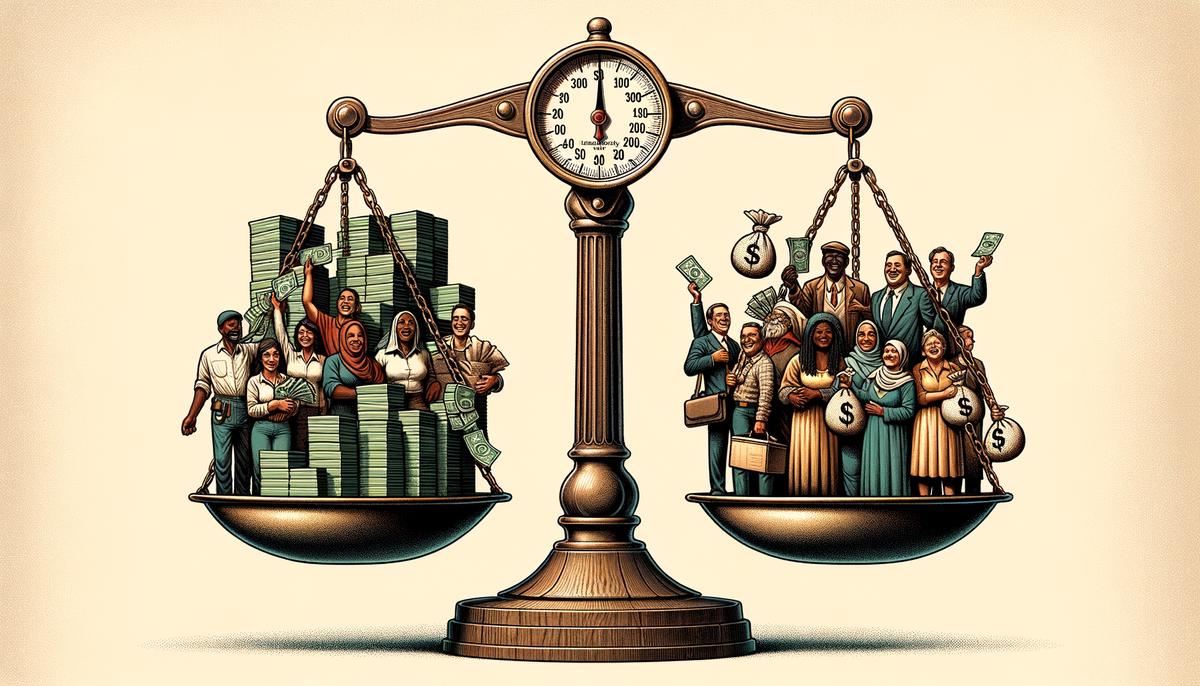

Ultimately, the intricate relationship between wage hikes, inflation control, public finance health, and employment stability paints a multifaceted picture. Decisions taken must navigate these interconnected elements to ensure economic decisions translate into equitable, sustainable growth.

Analyzing the broader implications, the prudence of the Bank of England in maintaining higher rates until inflation is evidently under control becomes evident. The balance remains tricky, compounded by the possibility of needing tax adjustments and managing public expectation for expanded worker rights and better wages.

- Bank of England

- HSBC

Leave a Reply