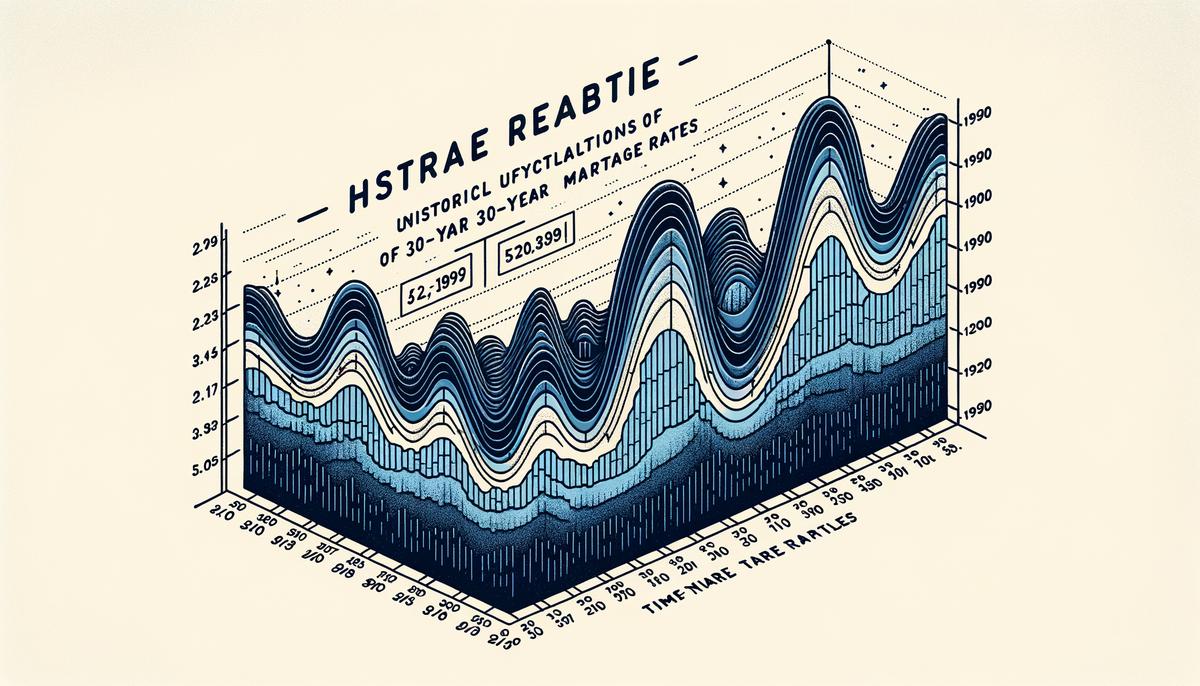

Decade-wise Mortgage Rate Trends

Mortgage rates over the past few decades have seen significant fluctuations, with notable highs and lows that have influenced the home buying market. In the early '80s, rates reached 18.63%, driven by Federal Reserve policies to control inflation1. Conversely, during the COVID-19 pandemic in the early 2020s, mortgage rates dropped below 3%. These changes highlight how economic policies, global events, and market sentiment impact mortgage rates.

Varying mortgage rates have affected homeownership accessibility. Low rates increase affordability, allowing more people to purchase homes or refinance existing mortgages. High rates, on the other hand, can make it more challenging for potential homeowners to enter the market. Understanding these historical patterns can help prospective homebuyers navigate the current market and make informed decisions when securing a mortgage.

Impact of Economic Policies on Mortgage Rates

The fluctuations in 30-year mortgage rates are significantly influenced by federal policies. The Federal Reserve's monetary policies are paramount in steering these rates. When the Federal Reserve adjusts the federal funds rate to combat inflation or stimulate the economy, it affects short-term and variable interest rates directly. Though less affected, 30-year mortgage rates still feel the impact of these policy shifts. These longer-term rates are influenced by expectations for inflation and long-term economic growth. As investors and financial markets react to the Federal Reserve's moves and economic outlook, bond yields that 30-year mortgage rates often move in parallel with are also affected.

Economic policies extend beyond the Federal Reserve's decisions. Federal government actions, such as spending and tax policies, impact overall economic growth and shape investors' outlooks on inflation, a key determiner of long-term mortgage rates. Federal policies aimed at enhancing financial stability or supporting the housing market can also play a significant role. Programs to purchase mortgage-backed securities, like those seen during financial crises, work to lower longer-term rates, making mortgages more accessible and affordable2. The interplay of federal action, economic indicators, and market sentiment charts the course of these important rates, impacting everyone from first-time homebuyers to seasoned investors looking to refinance.

Predicting Future Mortgage Rate Movements

Predicting future trends of 30-year mortgage rates involves analyzing economic indicators, Federal Reserve policies, and global events. Despite historical data which can guide understanding, future rate movements remain uncertain. Economists and analysts frequently attempt forecasts based on current trends, but these predictions should be considered with caution. The unpredictable nature of economic downturns, policy shifts, and global crises makes it challenging to pinpoint exact future rates.

An educated guess at future mortgage rates can be formulated by examining:

- Inflation expectations

- The Federal Reserve's monetary policy outlook

- The health of the global economy

Higher inflation could lead to interest rate hikes, potentially resulting in higher mortgage rates. Conversely, if the Federal Reserve signals a more accommodative stance to stimulate economic growth or counter a recession, mortgage rates may remain low or decrease further. However, the paths of economies are rarely linear, with surprises and reversals that can impact forecasts. While historical patterns offer guidance, accurately predicting where 30-year mortgage rates will head is a challenging task.

Understanding the changes in mortgage rates over decades provides valuable insights into the broader economic landscape that influences opportunities for homeownership. These patterns illustrate the impact of economic policies, global events, and market dynamics on personal financial decisions. For those looking to buy a home or refinance their mortgage, staying informed about these trends is important. While predicting future mortgage rates remains uncertain, being aware of past trends can help individuals prepare for potential changes in the market.

- Borodovsky S. Behind the Numbers: The First-Ever 30-Year Mortgage Rate. Wall Street Journal. Published 2021. Accessed June 10, 2023.

- Talavera M. The Impact of Fed's Mortgage-Backed Securities Purchase Program. Investopedia. Published 2022. Accessed June 10, 2023.

Experience the power of AI content creation with Writio. This article was crafted by Writio.

Leave a Reply